A RockSolid retrospective: one month post-launch

The RockSolid team is excited to provide a community update and retrospective one month after our successful launch! Note: We were intending to post this blog last week, but given the Stream Finance blowup, we posted a deep dive on that event last week instead.

We’ll use use this retro to do several things:

- Restate RockSolid’s guiding principles

- Highlight the success of our launch

- Reflect on the APR* of the RockSolid rETH Vault

- Preview what’s next for the vault

1) Restating our guiding principles

RockSolid adhered to these principles during the build and deployment of the rETH Vault:

Transparency and clear communication

We strive to be transparent (both onchain and offchain). Our strategies are listed at the bottom of our app under the "Portfolio" heading, with detailed weekly allocation and APR breakdowns. These deployments can be verified on Debank.

We aim to communicate clearly, avoiding jargon which masks what’s going on under the hood.

Our docs describe our product architecture, risks, trust assumptions, and design tradeoffs in plain English.

The best risk-adjusted rewards

We don’t simply chase the highest headline APR or other vanity metric. We seek the best risk-adjusted reward while maintaining liquidity for users and mitigating liquidation risk.

We want to be Rock Solid.

This means we don’t engage in highly leveraged and self-referential strategies.

This also means our APRs and TVL are going to look lower than other competing vaults that run aggressive highly leveraged strategies (and often also run self-referential loops on their own vault tokens to artificially inflate TVL). Such aggressive strategies are what caused much of the damage in the recent Stream blowup). We feel vindicated in our approach post-Stream.

Benefiting the Rocket Pool ecosystem

First and foremost the RockSolid rETH Vault aims to provide attractive APRs to rETH holders.

The rETH Vault was also designed to generate rETH demand and make rETH more useful in more places. We accept deposits in ETH, WETH, stETH and rETH, but convert all deposits to rETH (generating demand). We currently don’t sell rETH for other assets. When particular strategies only accept another asset (e.g. WETH), we borrow WETH against our rETH asset to avoid ‘sell pressure’ on rETH/ETH.

We negotiate with DeFi protocols to secure incentives for rETH pools, and to get rETH integrated into protocols where it wasn’t before.

2) Highlighting a successful launch

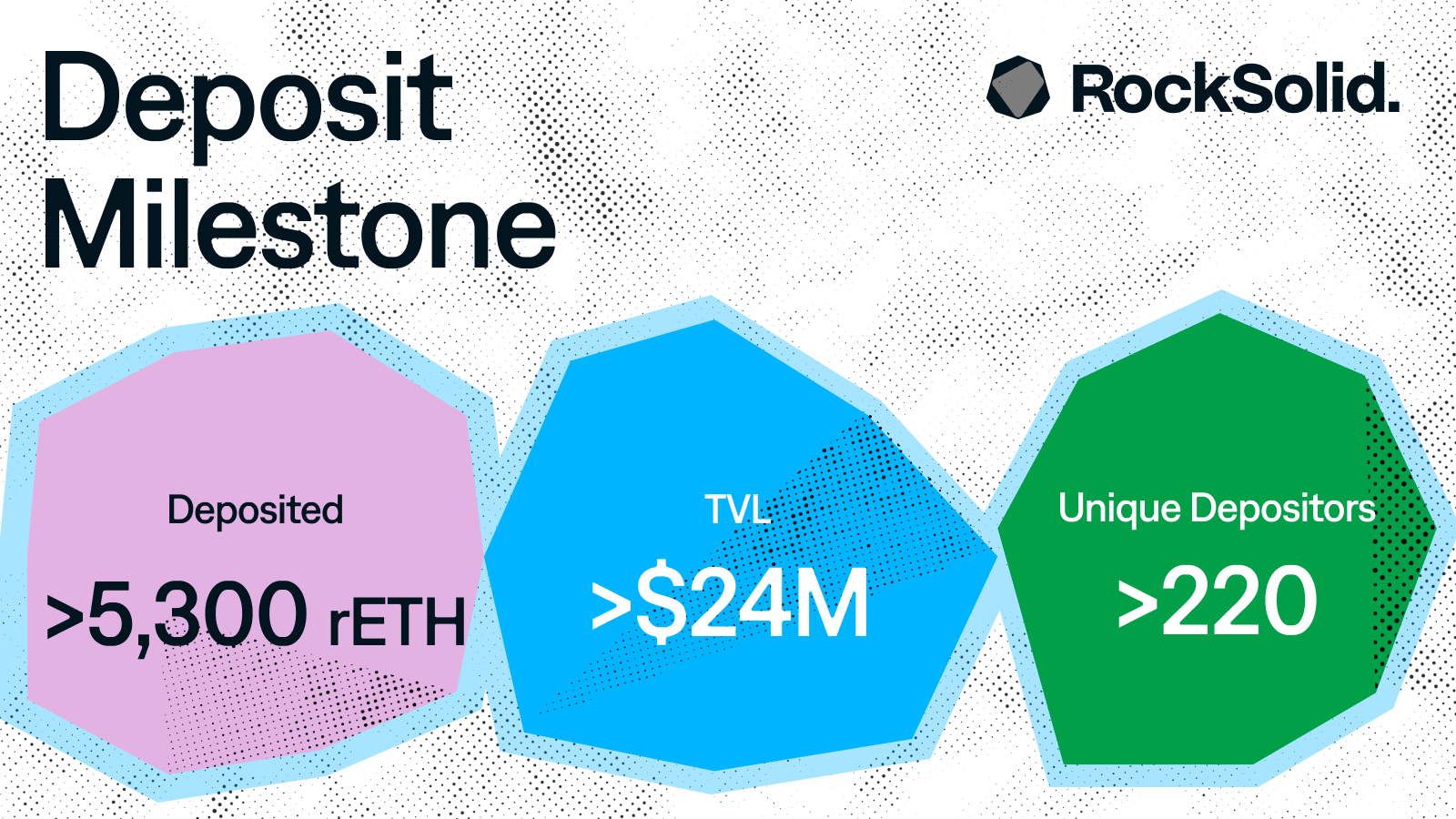

We’re proud of our launch, and wanted to call out some highlights from our first month. We’re especially proud of the organic growth of TVL (no private deals with private incentives, no ‘bribed’ mercenary capital).

TVL and depositor growth

- >5,300 rETH deposited

- >$24m USD equivalent deposited as at ETH prices pre-Stream

- >220 unique depositors

- Largest single deposit, 873 rETH

rETH demand

- >4,000 rETH purchased by depositors

rETH integrations

- rETH on Hemi (ETH L2) incentivized by Hemi protocol

- rETH on Ink (ETH L2 by Kraken) via Superbridge

- … and more underway not yet announced!

Resilience during the ‘Oct 10 flash crash’

- During the biggest liquidation event in crypto history, RockSolid experienced no liquidations and no losses

- During the Balancer exploit and Stream Finance blowup, RockSolid experienced no losses and had no exposure to toxic assets

- Our conservative and low leverage model operated as intended

- See a deep dive on our thoughts on these events in our previous blog post, and cofounder Ben's prior talk at ETH Denver on DeFi contagion risk

- RockSolid has experienced net inflows in the aftermath of these crises (as opposed to many other vaults that have seen TVL shrink by as much as 50%)

Media exposure

- Coverage in The Block

- Coverage in Castle Lab

- On the Brink with Castle Island Ventures podcast

- TeachMeDefi podcast

- Web3 with Sam Kamani podcast

- RocketFuel podcast

- Token2049

- EthereumNYC

- DevConnect speaking slots (Staking Summit, Vault Summit, ETH Staker Staking Gathering)

We're grateful for the support from the community that made all these achievements possible.

3) Reflecting on APR performance

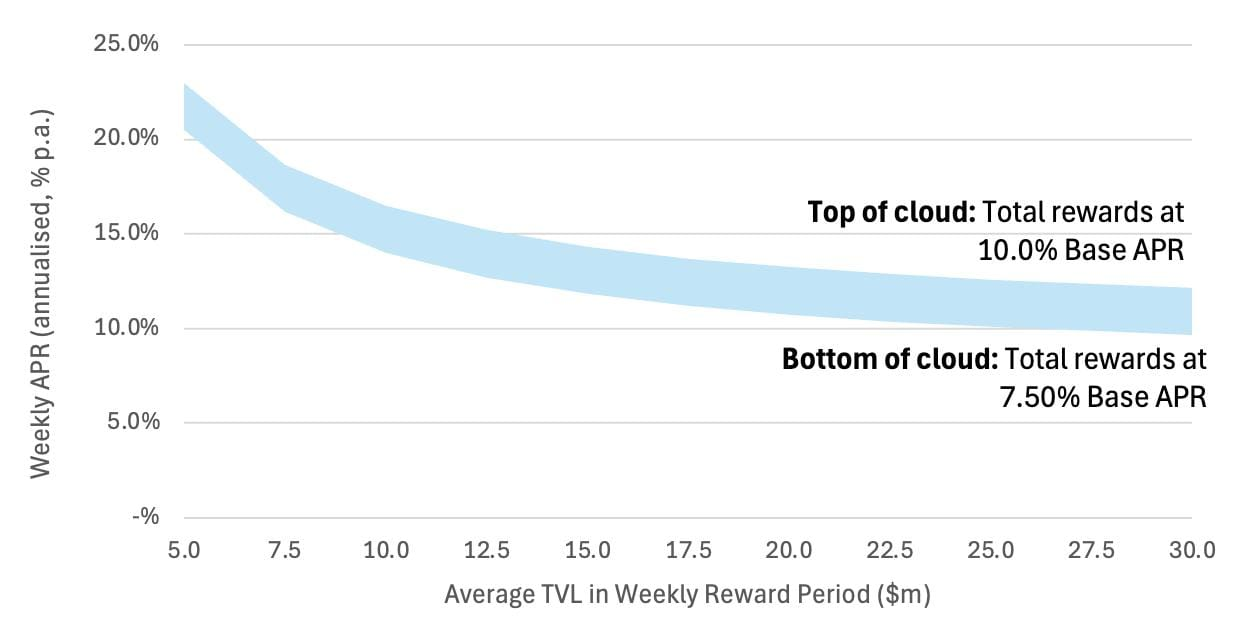

When we launched the vault, we estimated ~7.5%-10% base APR, with added incentives from the RockSolid team adding an additional 2.5%-12%. This put the total estimated APR ~10-22%.*

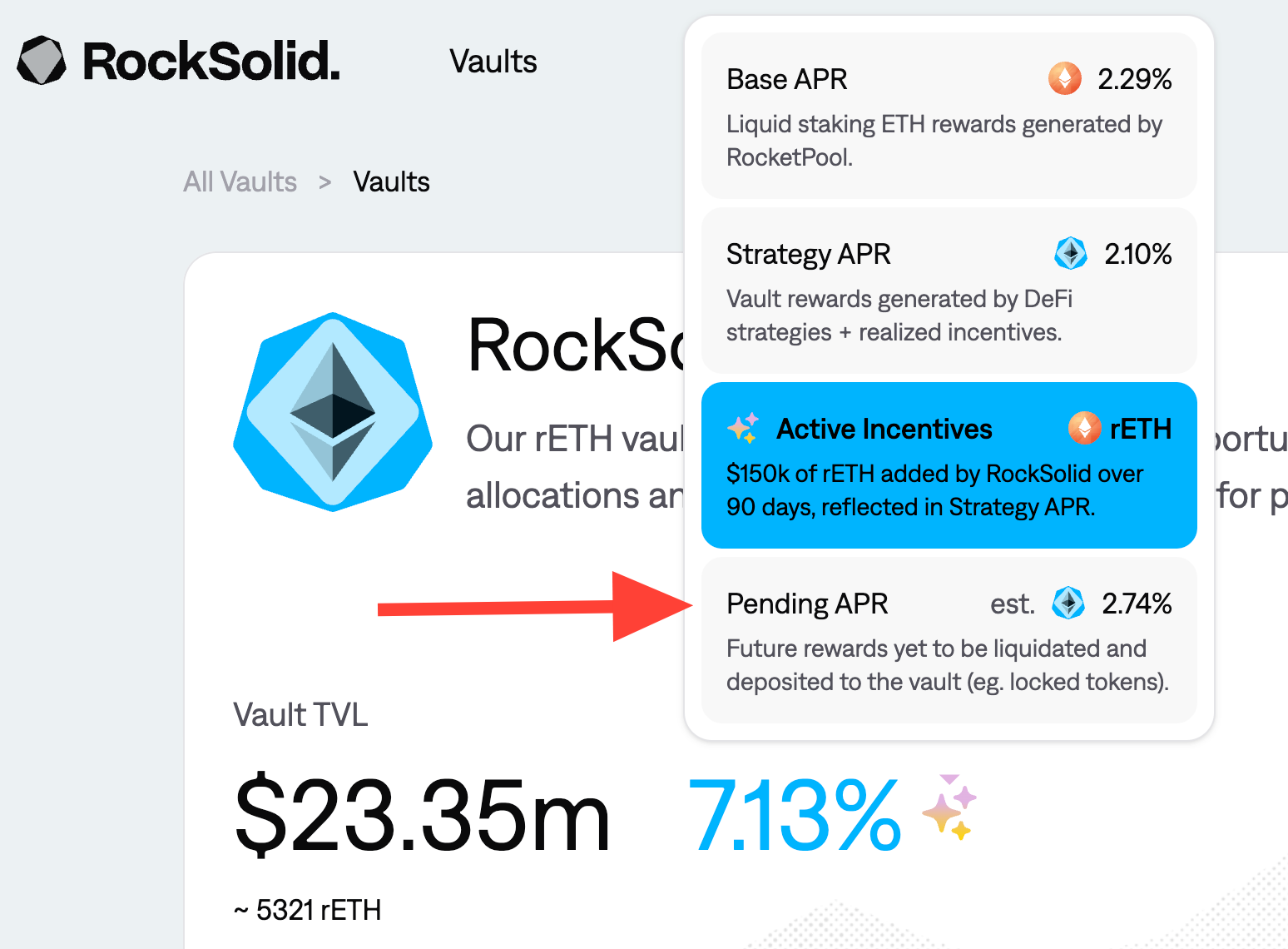

The total APR for the most recent weekly strategy report show the total APR ~7%.*

This is lower than our original estimate at launch for a few reasons:

i) RockSolid (fixed) incentives are operating as expected

RockSolid adds incentives to the vault each day - a fixed amount 0.3173 rETH per day. This equates to $150,000 USD equivalent from RockSolid's balance sheet over the course of 90 days.

As vault TVL grows, each individual depositor receives a smaller share of those incentives and APR thus decreases. This is working exactly as designed. The intention is to reward earlier depositors more generously. See the chart we originally published in our launch blog below:

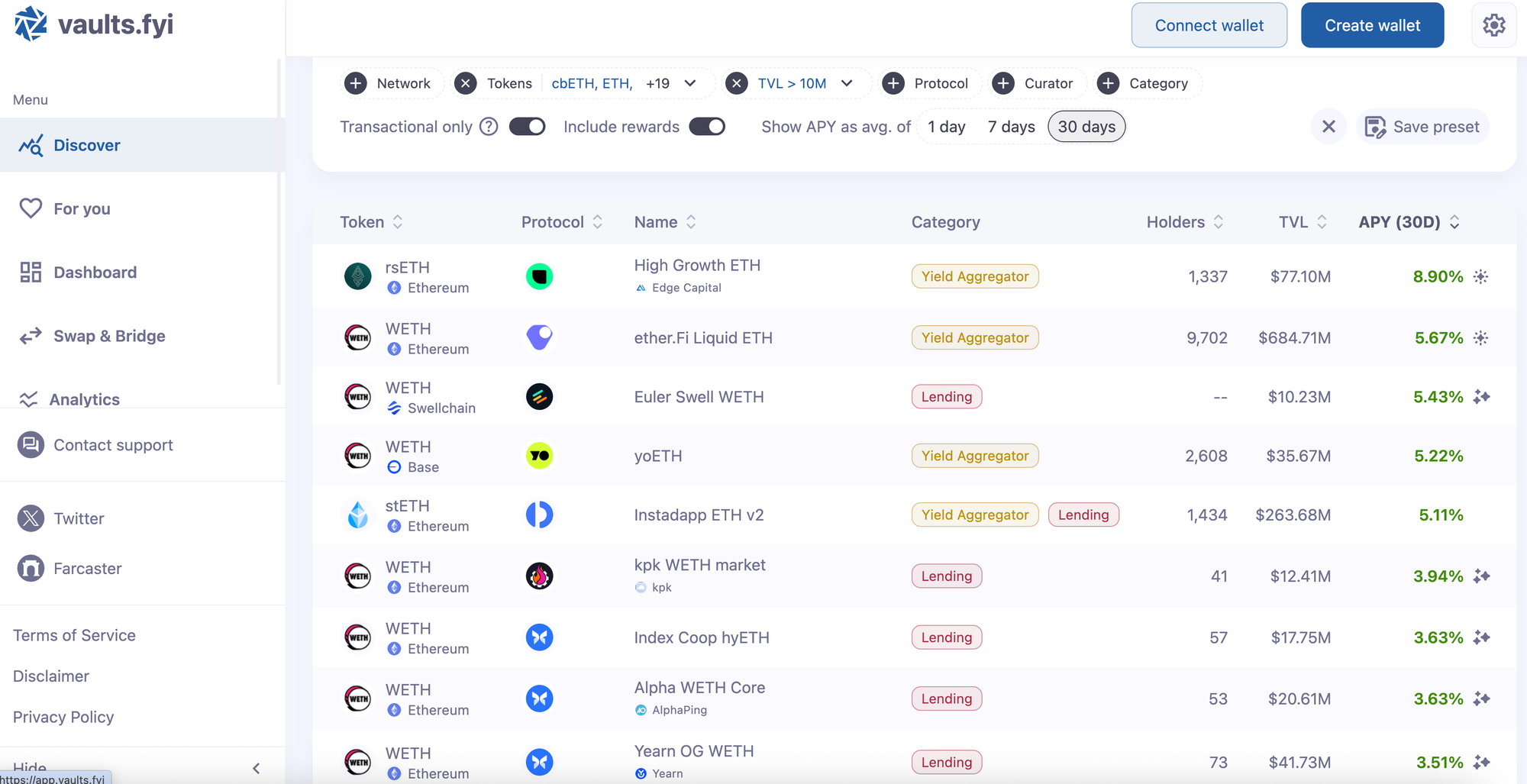

ii) ETH APRs across all of DeFi have fallen

ETH-denominated 'real yield' APRs have compressed all across DeFi in recent weeks and months. This has impacted all ETH vaults and strategies - not just RockSolid. Comparable vaults such as Lido’s or Ether.fi’s show similar APRs in the 3-5% range, compared to RockSolid’s at ~7%. Other vaults with much higher APRs are either engaged in highly risky strategies, or are putting 'estimates' (often inflated) on the valuations of unrealized 'points' being offered by protocols.

iii) Some strategies are still ramping up

Some of our newer strategies and integrations like Polygon and Ink are still ramping up to full deployment and aren’t fully captured in the APR reporting window yet.

iv) We loop conservatively

Other vaults have compensated for falling APRs by taking on more leverage and looping more aggressively. Indeed during recent market turmoil, some vaults have had trouble honoring timely withdrawals due to the cost and difficulty of unwinding their loops.

We have deliberately decided not to do this in order to avoid the liquidity and liquidation risks of high leverage (adhering to our guiding principles described above).

v) We pay borrow costs on ETH because we don't sell rETH

When a DeFi strategy doesn’t accept rETH directly, we work with that protocol to integrate rETH. In the interim before rETH is supported, to access the strategy we instead deploy WETH (or similar). We currently borrow WETH against rETH to avoid selling rETH. But this adds ~2% APR of borrow cost, which reduces headline APR. Note though that net APR is still positive from these strategies, since the borrow cost is less than the rETH staking yield, and the strategies themselves earn additional rewards.

3b) Explaining the differences between calculated vault share APR and reported APR

Some members of the community have calculated APRs by examining the change in on-chain vault share NAV values across time periods.

The onchain vault share NAV calculation is lower than the APR reported on our front-end because it excludes several sources of APR:

i) Unrealized airdrops

Several of RockSolid's current strategies involve farming airdrop incentives from DeFi protocols and chains (e.g. Linea, Ink, Katana). Conservatively, we choose not to recognize these accumulated incentives in NAV until they are realized (i.e. the airdrops are received and converted to rETH).

We transparently show expected value of these airdrops in the “Pending APR” section of our APR tooltip and weekly Portfolio Report.

The alternate approach would be to recognize these airdrops in NAV as they accrue, but this adds two risks: i) a liquidity mismatch since we’d be increasing the NAV of vault assets with assets that cannot be accessed or liquidated; ii) valuation risk if the future airdrops end up being worth less than expected (in this case, depositors who withdrew before the returns are realized would be 'paid out' at the higher unrealized value, effectively being subsidized by other depositors).

Additionally (to be conservative), we apply a discount to the expected value of future airdrops compared to what the project teams claim. Many other vaults apply the full (supposed) value of airdrops to their APRs. In contrast at RockSolid, if the project providing incentives to our vault says "Our token will be worth $500m FDV", RockSolid conservatively says "Let's assume the token is only worth $250m FDV" to avoid over-promising and under-delivering on APR.

ii) We report APR in ETH terms

The vault assets and accounting are denominated in rETH. This means vault share NAV calculations are reported in terms of the number of rETH in the vault. NAV calculations denominated in rETH ignore the staking rewards that rETH accrues via a change in the value of rETH.

We report APR on our front-end in ETH terms, which allows us to add the rETH staking yield into this number. See the screenshot above which transparently displays the "Base [Staking] APR" in the tooltip.

From the perspective of an ETH depositor (which is the majority of depositors - over 80% of vault depositors at time of writing swapped from a non-rETH asset prior to depositing), the rETH staking yield is a relevant part of the APR of the vault.

4) What’s next for RockSolid

Sourcing rETH-native integrations

We’re working with DeFi protocols and L2s to accept rETH directly, removing the ~2% borrow cost we’re currently incurring on some strategies.

Continuing to search for the best risk-adjusted APR

Part of the benefit of an actively managed vault is that we’re constantly in conversations with protocols and searching for new opportunities to earn APR.

Working with institutions and distribution partners

We’re in conversation with large institutional ETH-allocators to understand their needs. And we’re working with other protocols and distribution partners who could provide access to the RockSolid rETH Vault to their customers. We’re pursuing both of these paths to increase TVL.

Marketing and brand building

We’re heading to Argentina for Devconnect to meet more partners, depositors, and protocols. We’re speaking at Staking Summit, Staking Gathering, and Vault Summit to continue getting the RockSolid name out there.

As always, we welcome feedback and questions in the Rocket Pool Discord, or via DM on X @rocksolidHQ

* Targeted APRs are illustrative targets, not commitments, and actual returns are not guaranteed; for full details, please see our Terms of Service.

About RockSolid

RockSolid offers institutional-grade liquid vaults with managed DeFi strategies to help asset issuers and custodians generate higher rewards for token holders. Rewards are generated through active DeFi management, optimising DeFi positions and securing the best private deals available.